For road construction, municipal engineering, and highway infrastructure projects, the asphalt mixing plant is a critical piece of equipment—yet its price varies drastically from $50,000 to over $1 million. Many buyers struggle with “low-price quality concerns” or “overpaying for unnecessary features.” This article breaks down the core factors affecting asphalt mixing plant prices, provides 2025’s latest price benchmarks for popular models, and shares industry-specific procurement strategies to help you align budget with project needs while avoiding common pitfalls.

Asphalt mixing plant pricing is not a fixed figure but a result of synergistic effects between production capacity, technical configuration, mobility, and after-sales support. Understanding these factors is key to interpreting price differences and making informed decisions.

An asphalt mixing plant’s hourly output (measured in tons per hour, t/h) directly determines its core scale and supporting components, creating clear price tiers:

- Small asphalt mixing plants (10–80 t/h): Ideal for rural road repairs, residential community pavement projects, and emergency maintenance. Equipped with a single drum mixer, basic diesel heating system, and 2–3 bin aggregate batching units. Typical models include the LB800 (64 t/h) and LB1000 (80 t/h), with prices ranging from $50,000 to $120,000.

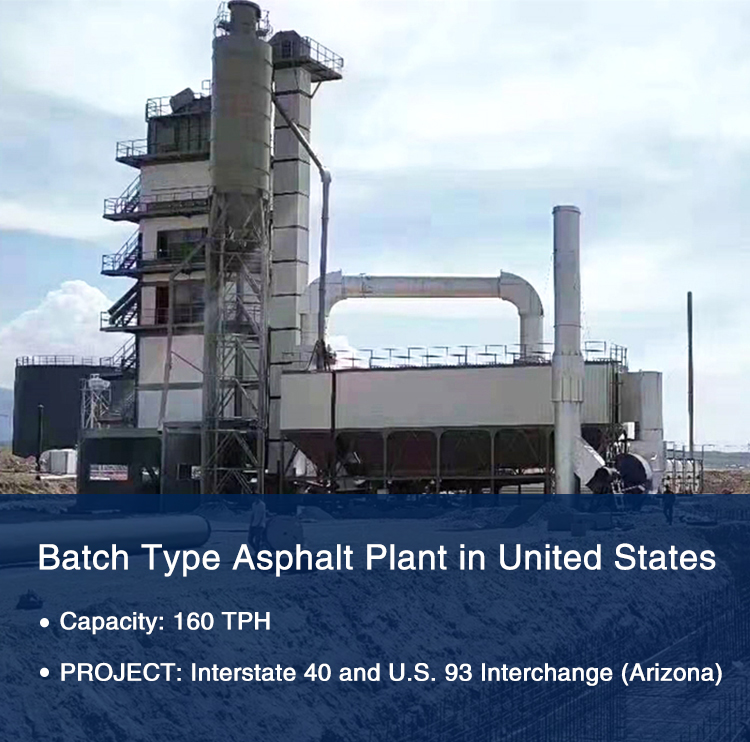

- Medium asphalt mixing plants (100–240 t/h): Suited for municipal road construction, county-level highway projects, and regional hot mix asphalt (HMA) production. Features dual-drum mixers or counterflow forced mixers, gas/diesel hybrid heating systems, and 4–5 bin aggregate dosing systems. Popular models like the LB1500 (120 t/h) and LB2000 (160 t/h) cost between $130,000 and $300,000.

- Large asphalt mixing plants (240–400 t/h): Designed for high-grade highway construction, airport runways, and large-scale infrastructure projects. Adopt modular designs, imported forced mixers (e.g., Ammann, Marini), full-process environmental control systems, and intelligent production management platforms. The LB3000 (240 t/h) and LB4000 (320 t/h) fall in the $400,000 to $1.2 million range, with custom ultra-low-emission models exceeding $1.5 million.

For plants with the same capacity, configuration differences can lead to 30–60% price gaps—rooted in the quality of key components:

- Mixing Drum/Mixer: Domestic standard drum mixers cost 30–50% less than imported counterflow forced mixers. For example, a 200 t/h plant with an imported Ammann mixer adds $80,000–$150,000 to the price but improves mix uniformity (asphalt coating rate ≥98%) and extends wear part life (e.g., mixer blades, liners) by 2–3 years.

- Heating & Temperature Control: Basic diesel heating systems have low upfront costs but high fuel consumption and poor temperature precision (±5℃). Upgrading to a gas-fired heating system with intelligent PID control (precision ±2℃) adds $25,000–$45,000 but reduces fuel costs by 30% annually.

- Environmental Equipment: Meeting global emission standards (e.g., EU Stage V, China GB 37822-2019) requires pulse baghouse dust collectors (for PM2.5 control) and activated carbon adsorption + catalytic combustion systems (for VOCs/NOₓ treatment). These add $80,000–$150,000 but avoid environmental fines and ensure long-term project compliance.

Mobility needs dictate equipment design and cost logic, with two main types available:

- Stationary asphalt mixing plants: Require concrete foundations and fixed installation, ideal for long-term HMA production yards or urban batching plants. For the same capacity, they cost 10–20% less than mobile models but incur additional infrastructure costs ($30,000–$80,000 for site hardening and 预埋件). The LB2000 stationary model (160 t/h) costs $180,000–$250,000.

- Mobile asphalt mixing plants (e.g., YLB series): Integrated on trailer or crawler chassis for on-site relocation (e.g., highway expansion, rural road projects). Feature hydraulic support legs and quick-assembly structures, making them 20–40% more expensive than stationary counterparts. The YLB2000 mobile model (160 t/h) ranges from $230,000 to $320,000.

Low-cost quotes often cut corners on service, while quality support adds value reflected in pricing:

- Installation & Commissioning: “Basic delivery-only” quotes omit on-site installation, which costs $8,000–$15,000 if outsourced. Reputable manufacturers include free installation and operator training, increasing the unit price by 5–8% but preventing costly errors (e.g., electrical shorts, component misalignment).

- Warranty Coverage: Warranties for core components (mixer, heating system) range from 1–3 years. Extending the warranty by 1 year adds 3–5% to the price—e.g., a 3-year warranty for the LB3000 (240 t/h) costs $15,000–$25,000 more but covers wear part replacements (e.g., burner nozzles, seal rings) in the early operational phase.

Below are 2025 Q1 price ranges for popular models (inclusive of basic configuration, free installation, and 1-year warranty; exclusive of shipping and site preparation costs) to match different project scales:

- LB800 (64 t/h): Single drum mixer, diesel heating, basic dust collection. Price: $50,000–$75,000 (ideal for rural road patching, small community projects).

- YLB1000 (80 t/h): Mobile trailer-mounted, 简易温控,quick setup (≤24 hours). Price: $80,000–$110,000 (suited for temporary construction sites).

- LB1500 (120 t/h): Stationary, dual-drum mixer, gas heating, 4-bin batching. Price: $130,000–$180,000.

- YLB2000 (160 t/h): Crawler mobile, pulse dust collection, hybrid heating. Price: $230,000–$320,000 (for flexible highway construction).

- LB3000 (240 t/h): Stationary, imported forced mixer, full environmental control, 余热回收 system. Price: $400,000–$550,000.

- LB4000 (320 t/h): Modular, AI-driven production optimization, remote monitoring, ultra-low emission. Price: $700,000–$1.2 million (for key national projects).

A $150,000 plant without a heat recovery system may cost $20,000–$30,000 more annually in fuel bills than a $180,000 plant with heat recovery. Over 5 years, the “cheaper” option becomes $50,000–$100,000 more expensive.

Some manufacturers inflate “theoretical capacity” by 20–30%. Request on-site production videos or visit the factory to test continuous 8-hour output—ensure the plant meets your project’s peak demand (e.g., a 120 t/h plant should consistently produce 960 tons in an 8-hour shift).

Environmental standards tighten annually. Add clauses for “future environmental retrofitting interfaces” (e.g., space for NOₓ treatment systems) to reduce upgrade costs by 20–30% later, avoiding premature equipment obsolescence.

To meet global carbon neutrality goals, low-carbon asphalt plants (with electric heating, waste asphalt recycling) will become mainstream. These models cost 15–30% more than traditional plants but qualify for government energy subsidies (e.g., 10–15% of the total cost in the EU and China).

Plants with AI-driven mix optimization (adjusting mixing time/temperature in real time) and remote predictive maintenance (fault alerts via cloud platforms) command 20–40% price premiums. However, they reduce labor costs by 15–20% and cut downtime by 30%.

The used market now offers 8–9 year-old plants (e.g., LB2000, YLB1500) at 50–70% of new prices, with third-party inspection and 6–12 month warranties. This is a cost-effective option for short-term projects (1–3 years).

In summary, asphalt mixing plant procurement requires balancing “project demand,” “total lifecycle cost,” and “future scalability”—not just chasing low prices. By focusing on configuration-productivity alignment and long-term value, you can select a plant that optimizes both performance and budget in 2025.